The following is a report on snags to be

faced by CFOs in 2020:

Transforming Geopolitical Quandary

into Sagacity

CFOs will oversee trade conflicts, Brexit

and supervise a latent economy slump. The

U.S.-China trade war has admonished U.S. companies to nurture vigilance.

Because of this, 56% of the CFOs at U.S. companies have instigated contriving

for a recession.

Trimming and Tightening

CFOs gauged that in the third quarter

capital spending would grow by 3.6% over the next 12 months, lower than

their outlook for 9.4% growth a year. In the fourth quarter of 2019, it reached

their rock-bottom since early 2017. U.S. business investment was sluggish

throughout 2019 schlepping down U.S. economic growth. CFOs’ worries about the

necessity to acclimatize and invent will burgeon in 2020 as more companies will

acquire automation to build proficiency and growth.

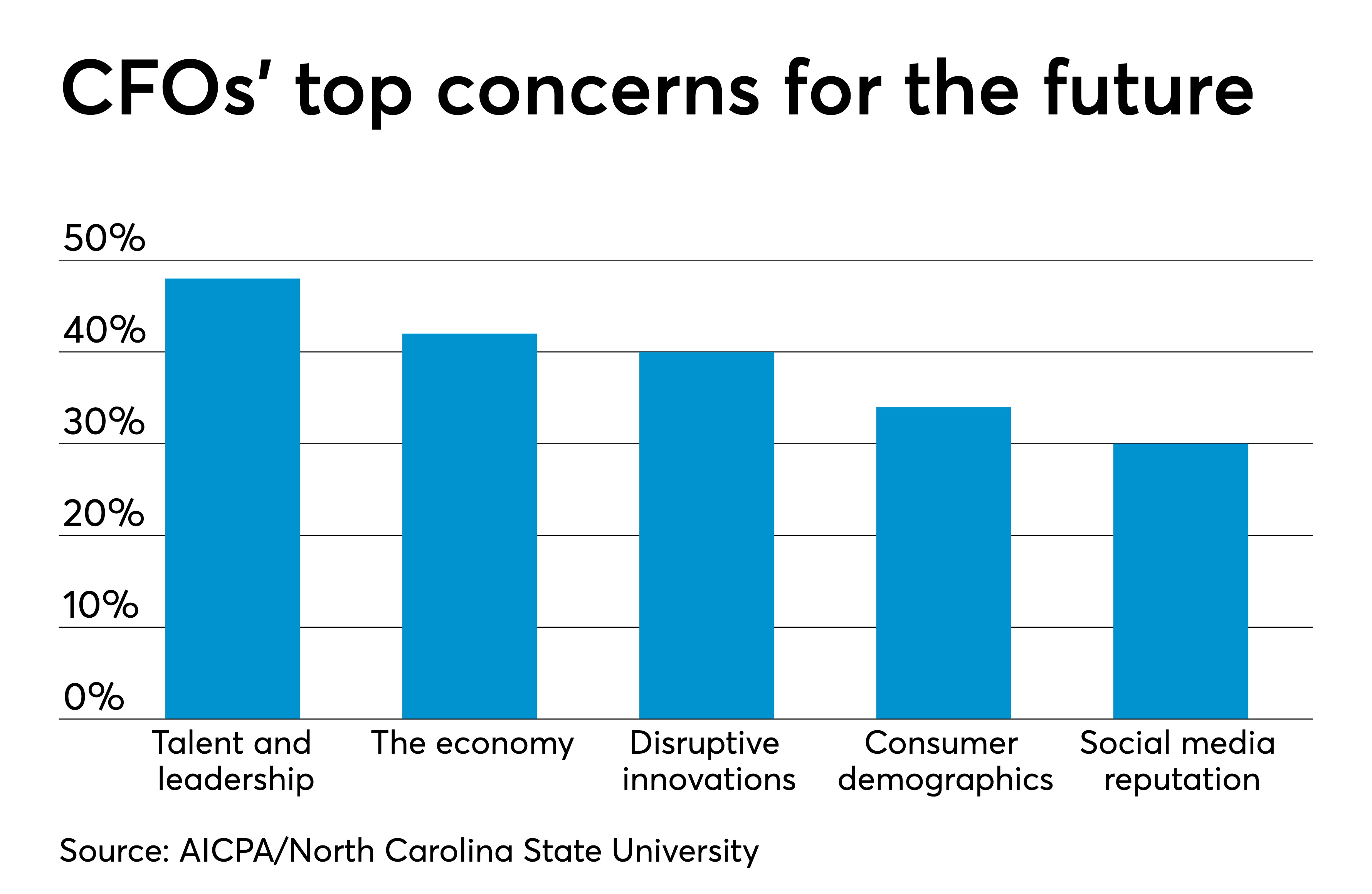

Quest for Talent

CFOs have to deal with the paucity of availability

of personnel and qualified finance professionals to perform roles that

extensively quench for technological maestros. Organizations have invested in

short-term job training programs and boot camps to train workers.

Existence of Bond Market

Competition

The bond market champions companies with low

interest rates, permitting them to borrow at more affordable rates. Chief

companies were in a gallop to issue new bonds to refinance short-term debt and

help cut interest expenses by supplanting existing debt with lower yielding

bonds.

Owning Valuable Companies

Mounting stock prices and truncated interest

rates benefit companies that want to grow through acquisitions. Companies that

can use the available capital and make adjustments should be able to maintain

M&A thrust.

Staying on top of the books

The Financial

Accounting Standards Board (FASB) is concentrating on

the matters of segregating liabilities from equity and improving the

measurement of goodwill for 1st half of the next year.

Comments

Post a Comment