By Vrinda Sachdeva

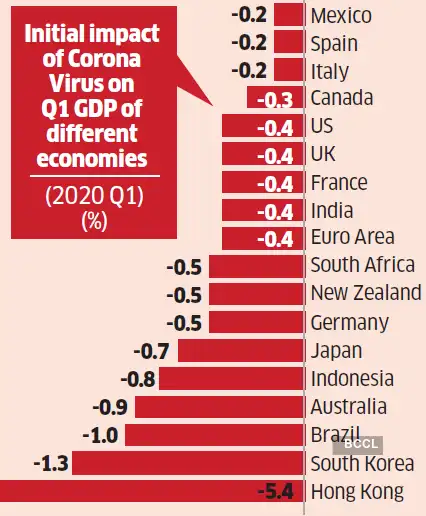

The outbreak of novel coronavirus i.e. COVID-19

has soared to an alarming rate. The death toll from China's new coronavirus

outbreak has jumped to 3,352. Governments around the world are scrambling to

contain the spread of COVID-19. From stocks to bonds and currencies to

economies, the coronavirus outbreak is rocking all corners of financial markets.

This matter has caused fear amongst Industry leaders. Less consumption, idle

factories, and broken global supply chains, the world would see the effects of

this virus. As the danger of economic impact is spreading, the Stock market

around the globe is crashing.

Not just that, the Chinese Large New Year's

events were canceled, tourist attractions and cinemas were closed. Making the

matter worse, the doors remain closed at around 2,000 Starbucks, hundreds of

McDonald's restaurants, 130 Uniqlo shops and at 30 Ikea stores.

While oil has plunged into a bear market, with

a 6.4% decline, the oil prices have dropped precipitously. But the oil industry

is not the first of many to have a downfall because of the COVID-19. It doesn't

seem to get better from here, the matter is getting worse. Near the affected

areas, the companies have started removing their staff. Evacuating 38

international employees along with their families, the French automotive group

Peugeot is destined to begin 2020 with a substantial financial blow. In the

coming days, even the US government is planning to relocate its citizens and

consular staff from Wuhan.

While coronavirus is throttling the economy,

Prime Minister Justin Trudeau has said: "I will continue to ensure that

the economy does not become subject to a slowdown that would hurt

Canadians". The Fiscal policy would be efficient to stimulate the economy.

This would help the people who will be staying at home to take care of their

children, to have some money in their bank accounts. It wouldn't be wrong to

say that more pain is on its way. The only question is, how painful will it be.

Comments

Post a Comment